Have you heard about the Open Sky Secured Credit Card? If you’re looking to build or rebuild your credit, this card might be a good choice for you. Let’s dive into the details and see what makes this card special.

What is the Open Sky Secured Credit Card?

The Open Sky Secured Credit Card is a type of credit card that requires a security deposit. This deposit acts as your credit limit. For example, if you deposit $200, your credit limit will be $200. This card is designed to help people build or rebuild their credit history.

Credit: wallethub.com

How Does the Open Sky Secured Credit Card Work?

It’s pretty simple:

- You apply for the card and provide a refundable security deposit.

- You use the card to make purchases, just like any other credit card.

- You pay your bill on time each month.

- The company reports your payment history to the credit bureaus.

By making regular, on-time payments, you can improve your credit score over time.

Benefits of the Open Sky Secured Credit Card

Here are some of the benefits:

- No Credit Check: You can get this card without a credit check, making it ideal for those with poor or no credit history.

- Reports to All Three Major Credit Bureaus: Your payment history is reported to Equifax, Experian, and TransUnion, helping you build credit.

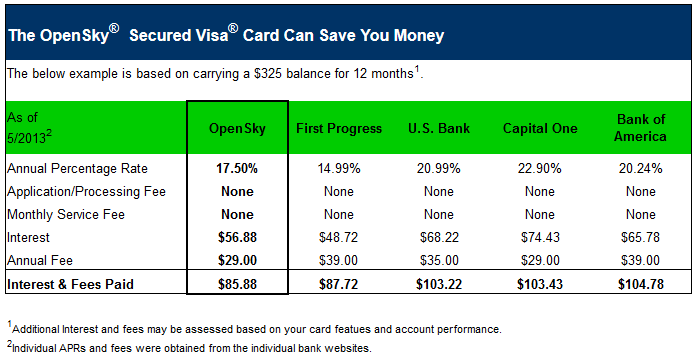

- Low Annual Fee: The annual fee is quite low compared to other secured cards.

- Flexible Credit Limit: Your credit limit can range from $200 to $3,000, depending on your security deposit.

Credit: businesscreditblogger.com

Drawbacks of the Open Sky Secured Credit Card

While the card has many benefits, there are some drawbacks to consider:

- Security Deposit Required: You must provide a refundable security deposit to get the card.

- No Rewards Program: Unlike other credit cards, this one does not offer rewards like cash back or points.

- Foreign Transaction Fees: There are fees for using the card outside the United States.

Who Should Get the Open Sky Secured Credit Card?

This card is great for:

- People with poor or no credit history.

- Those looking to rebuild their credit.

- Anyone who wants a credit card without a credit check.

Customer Reviews

Here are some reviews from real customers:

- John: “I had a low credit score and needed a way to improve it. The Open Sky Secured Credit Card was perfect for me. My score has gone up 50 points in just a few months!”

- Sarah: “I love that there was no credit check. The application process was easy, and I got approved quickly.”

- Mike: “The annual fee is low, and it’s worth it for the chance to rebuild my credit. I just wish they had a rewards program.”

How to Apply for the Open Sky Secured Credit Card

Applying for the card is easy:

- Visit the Open Sky Secured Credit Card application page.

- Fill out the application form with your personal information.

- Provide your security deposit.

- Submit your application and wait for approval.

Tips for Using the Open Sky Secured Credit Card

Here are some tips to help you make the most of your card:

- Pay Your Bill On Time: Always pay your bill on time to avoid late fees and improve your credit score.

- Keep Your Balance Low: Try to keep your balance below 30% of your credit limit. This shows that you are responsible with credit.

- Monitor Your Credit Score: Check your credit score regularly to see your progress.

Frequently Asked Questions

What Is The Open Sky Secured Credit Card?

The Open Sky Secured Credit Card is a credit-building tool for those with poor or no credit history.

How Does The Open Sky Card Work?

The card requires a refundable security deposit, which becomes your credit limit, helping you build credit responsibly.

Does Open Sky Require A Credit Check?

No, Open Sky does not perform a credit check, making it accessible for those with poor credit.

What Are The Fees For Open Sky?

The card has a $35 annual fee, but it has no application or processing fees.

Can I Increase My Open Sky Credit Limit?

Yes, you can increase your limit by adding more to your security deposit.

How Long To Receive Open Sky Card?

You typically receive the card within 10-14 business days after application approval.

Does Open Sky Report To Credit Bureaus?

Yes, Open Sky reports to all three major credit bureaus, aiding in building your credit score.

What Is The Interest Rate For Open Sky?

The APR for purchases is currently 21. 89%, which is standard for secured cards.

Is Open Sky Good For Building Credit?

Yes, consistent on-time payments can significantly improve your credit score over time.

How To Apply For Open Sky Card?

Apply online via their website by filling out a simple application form and providing your security deposit.

Conclusion

The Open Sky Secured Credit Card is a great option for anyone looking to build or rebuild their credit. With no credit check, a low annual fee, and the ability to set your own credit limit, it’s a flexible and accessible choice. Remember to pay your bill on time and keep your balance low to see the best results. Ready to get started? Apply for the Open Sky Secured Credit Card today and take the first step toward improving your credit!

For more information, visit the Open Sky Secured Credit Card application page.

Leave a Reply